- Cooling inflation boosts rate-cut hopes: U.S. CPI and core CPI both came in below expectations in September, fueling market bets that the Federal Reserve could cut interest rates as early as its next meeting, with another possible move in December.

- Markets rally on dovish expectations: Softer inflation data triggered gains across major U.S. stock indices, a drop in 10-year Treasury yields below 4%, and a weaker dollar against the euro.

- Risks and uncertainty remain: Despite easing price pressures, new tariffs, weak consumer sentiment, and potential data disruptions pose challenges for the Fed as it weighs balancing inflation control with supporting growth.

The September consumer inflation (CPI) report in the United States has provided markets with long-awaited signals of a potential shift in the Federal Reserve’s monetary policy. Both the headline CPI and its core measure came in below market expectations, increasing the likelihood of a rate cut at the upcoming Fed meeting — and possibly another one in December.

Inflation Weakens – CPI and Core CPI Below Forecasts

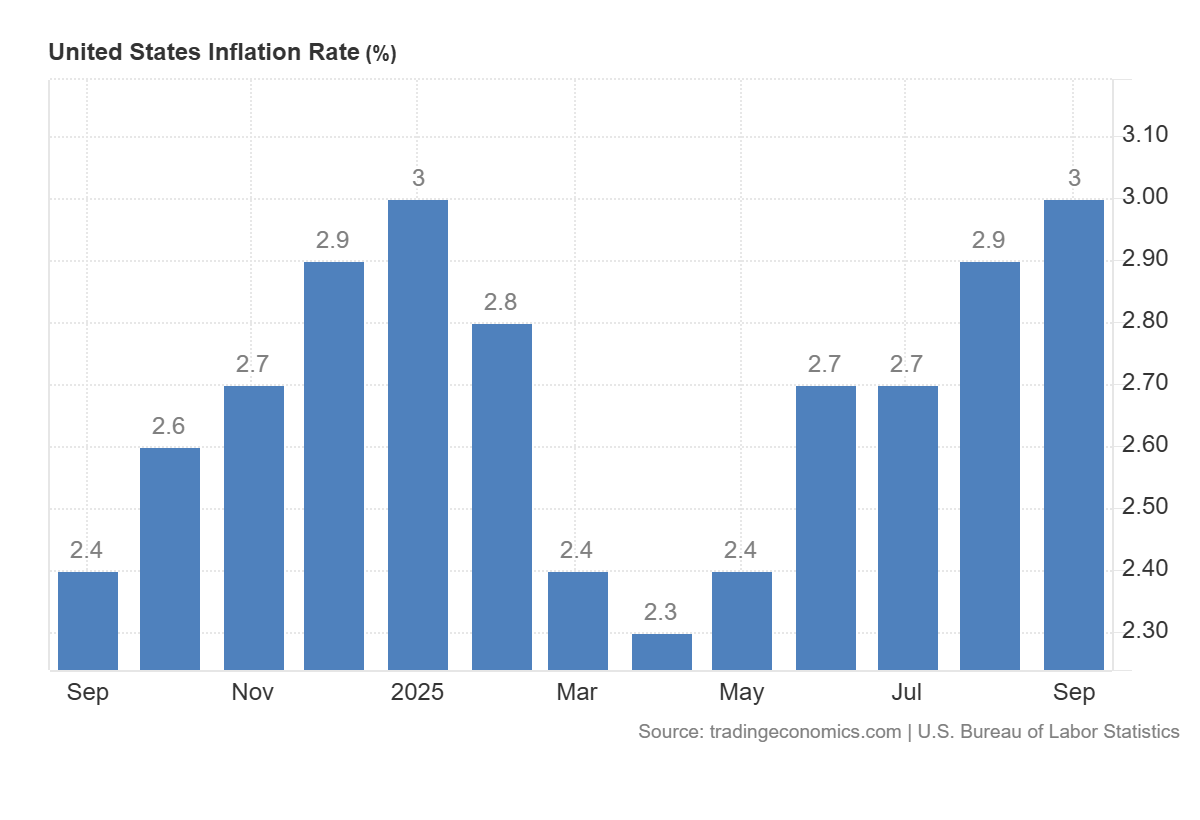

According to the published data, headline CPI rose by +0.3% month-on-month, compared to expectations of +0.4%, while core inflation — which excludes food and energy prices — increased by just 0.2%, the smallest gain in three months. On an annual basis, both indicators held steady at 3.0%, also below forecasts (3.1%).

A particularly notable development was the slowdown in housing costs. The owners’ equivalent rent, a key component of services inflation, rose by only 0.1%, marking its slowest monthly increase since early 2021. This reading may be seen by the Fed as confirmation that previous rate hikes are effectively curbing price pressures in the economy.

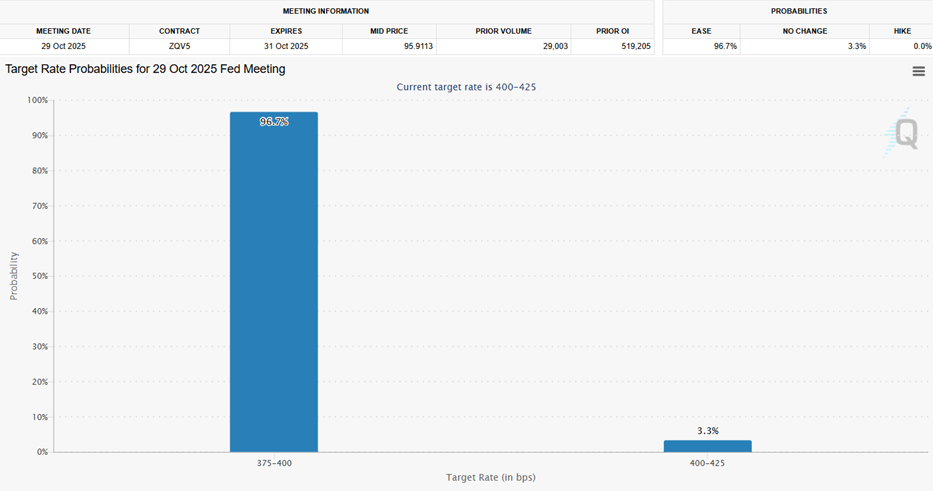

Room for Rate Cuts – Market Prices in Easing

In light of these figures, market expectations for monetary policy have shifted significantly. Investors are now pricing in an almost certain 25-basis-point rate cut at the Fed’s next meeting. Moreover, the probability of a second cut in December has increased — particularly since a potential federal government shutdown could prevent the release of additional inflation data before year-end, making the September report even more crucial.

Although inflation is cooling, risks to the price outlook remain. New tariffs announced by President Donald Trump — including on kitchen and upholstered furniture — could raise the prices of imported goods in the coming months. Companies such as Procter & Gamble and O’Reilly Automotive admit that while they are currently absorbing higher costs through margins, they will increasingly be forced to pass them on to consumers.

Market Reaction: Stock Rally, Lower Yields, Weaker Dollar

Lower inflation and rising expectations of a looser monetary policy had an immediate impact on financial markets. Major U.S. stock indices recorded strong gains:

- Dow Jones up 1.17%,

- Nasdaq 100 up 1.14%,

- S&P 500 up 0.89%.

Yields on 10-year Treasury bonds fell below the 4% level, signaling a shift in investor expectations about the future path of interest rates. Meanwhile, the U.S. dollar weakened, reflected in the EUR/USD exchange rate, which rebounded from 1.1580, which it reached on Wednesday. Whether these trends continue will depend on future Fed communications and potential confirmation of a rate cut decision.

Consumers Not Sharing the Optimism – Sentiment Weakens

It is worth noting, however, that despite market optimism, U.S. consumer sentiment has deteriorated. The University of Michigan index fell in October to 53.6 points, its lowest level in five months. Consumers continue to cite inflation and high living costs as their main sources of concern. Declining confidence could eventually weigh on consumption dynamics and, consequently, on the pace of economic growth.

Conclusions: Fed at a Crossroads – Markets Benefit, but Risks Persist

The September inflation data have clearly increased the likelihood of monetary easing by the Fed, already boosting equity indices and weakening the dollar against the euro. However, the Federal Reserve still faces the difficult task of balancing inflation control with support for the real economy.

New risks loom on the horizon — from protectionist tariffs and consumer uncertainty to the potential lack of further macroeconomic data due to government disruptions. In the coming weeks, not only the data itself but also the Fed’s communication and market reactions to every signal will be crucial for future movements on both Wall Street and the foreign exchange market.

Opinions are the authors’; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. The provided publication is for informational and educational purposes only.

If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please refer to the MarketPulse Terms of Use.

Visit https://www.marketpulse.com/ to find out more about the beat of the global markets.

© 2025 OANDA Business Information & Services Inc.