The US Dollar is opening the week on a sharp descent, with few catalysts to show for it.

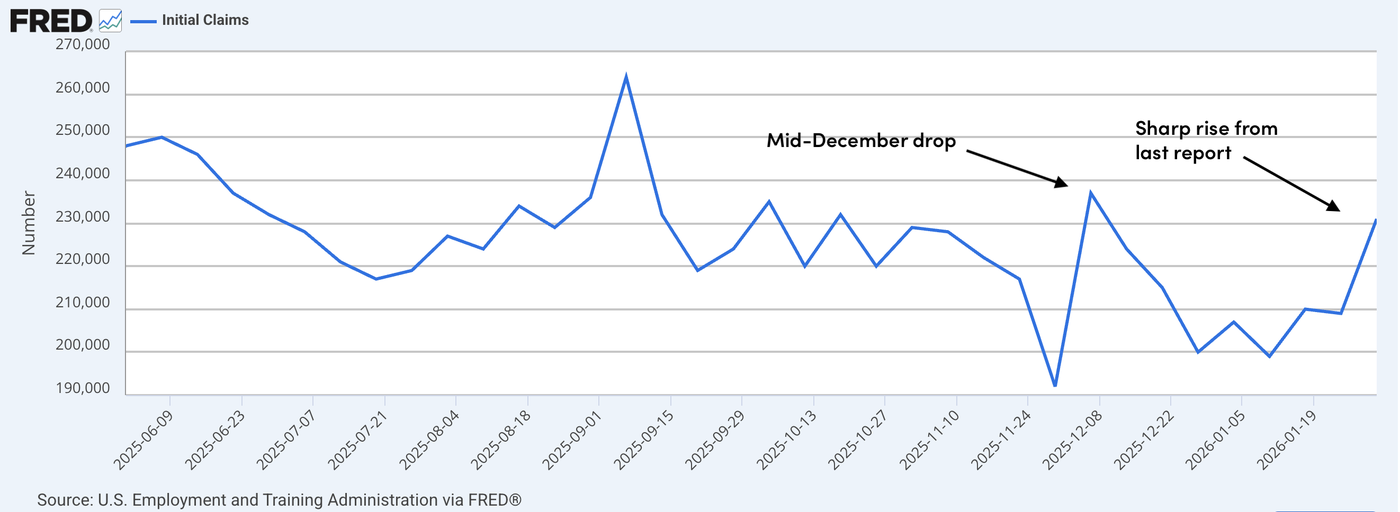

Are participants getting ready for dovish Non-Farm Payrolls? It could surely be the case.

Last week showed a startling turn in pre-NFP labor surveys. Jobless Claims reached their highest in since early December, Challenger layoffs sent out another 2008-2009 comparison, and even the previously rebounding ADP private payrolls surprised to the downside.

If it were only expectations of a soft number on Wednesday, however, that would traditionally translate into lower yields across the board.

The US yield curve is steepening (expecting lower Federal Reserve rates ahead), but bonds are broadly unchanged on the day.

US 10Y Yields Weekly Chart

Apart from sell-the-fact news in the Yen after Sanae Takaichi’s landslide victory in the Japanese snap elections, taking USD/JPY back below 156.00, other FX currencies are also taking their turn on dollar weakness.

The Greenback is at the bottom of the Major currency board in today’s session.

Dollar Index (DXY) 4H Chart

The Dollar Index erased its February gains and will test a strong Support range (96.50 to 97.00) amid oversold RSI levels – is the reversal overextended?

Check out more levels for the US Dollar in our recent DXY in-depth analysis.

Stocks and Commodities are also rebounding to start the week, with metals taking more than a breather, extending higher in their 3rd consecutive sessions of gains.

Gold is now back comfortably above $5,000 in today’s rise (and even, $5,100!), indicating that the safe-haven is still far from being out of the picture for investors – China did reveal that January was their 15th month of acquisitions for the Bullion, reflecting their cautious stance with the US Dollar.

By the way, Chinese regulators recently demanded that Banks reduce their reliance on US Treasuries, marking a new turn in the financial Cold War.

Gold 4H Chart

Oil isn’t gapping lower like in last week’s open when WTI dropped 7% (actually up above 1% today).

US-Iran ongoing discussions are also a factor, maybe one for surprise as the world slowly turns its attention away from US military assets amassing in the region – Keep the latest news in check.

A large bull flag seems to be forming – It developing could point to $72 in Oil but will depend on Iran developments.

US Oil (WTI) 4H Chart

With limited data, trends, or headlines, this session’s drop in the US Dollar could provide interesting mean-reversion setups ahead of Wednesday’s Non-Farm Payrolls report.

Keep a close eye on tomorrow’s Retail Sales data (8:30 A.M.; +0.4% m/m exp) as any beat could stage a swift bounce.

And the same counts for Non-Farm Payrolls and Friday’s inflation data.

Despite today’s weakness in the dollar, the flows seem more like mean-reversion from early February flows than the start of a restarting Debasement Trade.

This week will be a massive test for Markets, so get ready!

Read More: US NFP and CPI double-decker – Markets Weekly Outlook

Safe Trades!

Follow Elior on Twitter/X for Additional Market News, interactions and Insights @EliorManier

Opinions are the authors’; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. The provided publication is for informational and educational purposes only.

If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please refer to the MarketPulse Terms of Use.

Visit https://www.marketpulse.com/ to find out more about the beat of the global markets.

© 2026 OANDA Business Information & Services Inc.